Money Is DEAD; Is That Good Or Bad?

Look out, world! Like it or not, money is pretty much DEAD. However, is this a positive advancement for the future of humanity, or a colossal disaster waiting to happen?

Current Events

What is money? As a society, we’ve all collectively decided it is a printed denomination on paper — although it could be anything. Over the centuries, cash was once a rock. Then it became the bartering of services or valued property, such as using a goat or a cow to purchase goods or services from someone.

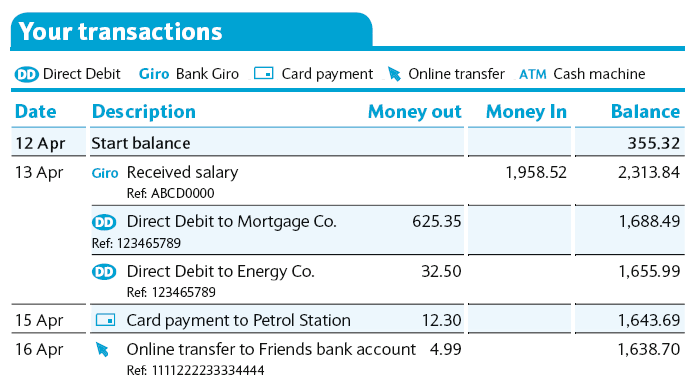

These days, money mostly doesn’t exist and is merely a series of numbers that gets recorded and traded around via financial institutions. For example, if you own a million dollars, that money is not physically sitting in a cave somewhere until you need it. Instead, it’s a number that some official “bookkeeper” has recorded in your name and will either add to, subtract from, or transfer to anyone you designate depending on your earning or spending habits.

Since money is now considered “worth” and no longer something physically tangible, we’ve all started using credit cards, online services such as PayPal and Venmo, and/or the wave of a cell phone or watch to buy absolutely anything. We no longer need a wallet or suitcase full of cash to transact a purchase.

And therein lies the problem.

With physical cash on its last legs and knocking at death’s door, are we on the verge of creating a society of “haves” and “have-nots?”

Consider this: in order to receive a credit or debit card you need a bank account. In order to get a bank account, you need an address, an ID, and frequently an employer who is feeding your account via direct deposit paychecks. In order to use a service like PayPal or Venmo, you need a credit/debit card or a bank account. Yes, it’s a Catch-22.

Consider this: in order to receive a credit or debit card you need a bank account. In order to get a bank account, you need an address, an ID, and frequently an employer who is feeding your account via direct deposit paychecks. In order to use a service like PayPal or Venmo, you need a credit/debit card or a bank account. Yes, it’s a Catch-22.

Granted, most of us have these societal necessities. However, there is a large contingency of us who do not. The homeless, undocumented immigrants, or even (some) teenagers are all members of society who still rely solely on physical money to do just about anything.

For example, a homeless person’s sole source of income may only come from money they found or was given to them. An undocumented person’s sole source of income may come from mowing someone’s lawn and getting paid in cash. A teen may only have their cash allowance to spend. So, when that homeless person needs to buy a sandwich to eat, or that undocumented person needs to buy groceries to feed their family, or that teen needs to pay for a dinner date, they’re all going to use physical money.

And therein lies the problem.

With the advancement of “digital” cash, many stores and businesses have begun a NO CASH policy. For example, the Tender Greens salad chain (with 28 restaurants on the East and West coasts) has shunned cash and will only accept credit/debit cards or a contactless payment system such as Apple Pay. Additionally, Starbuck’s and Shake Shack have also begun testing the use of cashless kiosks.

With the advancement of “digital” cash, many stores and businesses have begun a NO CASH policy. For example, the Tender Greens salad chain (with 28 restaurants on the East and West coasts) has shunned cash and will only accept credit/debit cards or a contactless payment system such as Apple Pay. Additionally, Starbuck’s and Shake Shack have also begun testing the use of cashless kiosks.

Restaurant owners say NO CASH (or worse, coins) makes the ordering process much faster. They also acknowledge the benefit of needing less time for counting bills, no armored-car fees, or the threat of armed robberies.

However, not everyone is on board with the digital death of money.

Last month, Philadelphia became the first major US city to ban cashless stores and restaurants.

City Council members ruled that cashless stores unintentionally discriminate against people in the community who don’t have debit or credit cards. They argued that cash is a necessity for those who may want to keep their purchasing history private from retailers, credit card companies, or spouses. Additionally, they agreed that cash as a payment option negates the potential risk of a company being breached or a customer’s information hacked.

The Chicago City Council is weighing a similar proposal that all city merchants accept cash. Massachusetts has had a Discrimination Against Cash Buyers rule on their books since 1978.

“Not everybody is able to buy a smartphone. Not everybody is in a position where they can get a credit card. Not everybody is even in a position where they have a stable bank account to be able to use the debit card. But they are hungry too, and have $10 in their pockets and they would like to spend their legal American form of tender, known as cash, with you.” – Arianne Bennett, owner of Amsterdam Falafelshop.

Are Philly, Chicago, and the others on to something? Should cash still remain an option for those who either can’t or simply choose not to get or use a credit/debit card? Or, with most of us already carrying little to no cash around with us anymore, is the death of physical money already inevitable?

Are Philly, Chicago, and the others on to something? Should cash still remain an option for those who either can’t or simply choose not to get or use a credit/debit card? […] – DJ

Yes. ….and Yes.

I do think money is dead and there is nothing anybody can do to stop it. The thing that killed off money is coins. When you go to the store nobody wants to carry those coins. So they use a credit card to pay instead just so they don’t get any change back. It is just easier all the way around. The first money I want to see killed off is pennies. That is the most useless thing there is. Plus it cost more to make the thing than it is worth.

I could be wrong but I’m guessing DJ resides in a big city. BD I’m guessing you probably do too….lol

But seriously. Do you two gentlemen have ANY idea how many Millions of Americans age 50 and older are still out there?! To say nothing of the Millions of aging baby-boomers who have NO intentions of giving up their entire way of life altogether just to please “the younginz.”

Now I’m not saying cash doesn’t have a date with destiny (I’m a realist). Of course it does.

I’m just saying I think reports of its “imminent death” are greatly exaggerated. As long as baby-boomers still hold most of the positions of power in Our country Ca$h will still be around. But we shall see.